What are HS Codes?

HS Codes are defined as Harmonised Systems Codes and are the standardised numerical description and coding system developed by the World Customs Organization (WCO).

The codes are designed to help identify and classify internationally traded goods for import and export.

The system covers more than 5,000 commodity (or category) groups, each identified by a unique six-digit code. These six-digit codes are used by customs to identify the product(s) in question and can be referred to as ‘commodity codes’ or ‘trade tariff commodity codes’.

Today, the World Customs Organization recognises over 5,000 commodity groups. These commodity groups are classified into 21 sections and grouped into 99 chapters; with the system used by more than 200 countries internationally from Brazil to China.

The system categorises over 200,000 types of products in international world trade and is updated every five years.

Imagine the sheer scale of goods moving in the global trade market. In today’s global economy, British consumers are used to seeing goods imported from every corner of the world from Costa Rican bananas and plantains to technology from China.

Imports from oversees provide greater choice but importing/exporting goods can be complex, however HS codes should not be a concern.

However, they are used across a range of areas. These include the verification of regulated commodities, freight rates/tariffs, country-specific taxes, quota limits, trade policies, and economic research and analysis.

UK based importers and exporters can find the relevant product HS code using the UK Tariff Classification tool.

The Structure of HS Codes

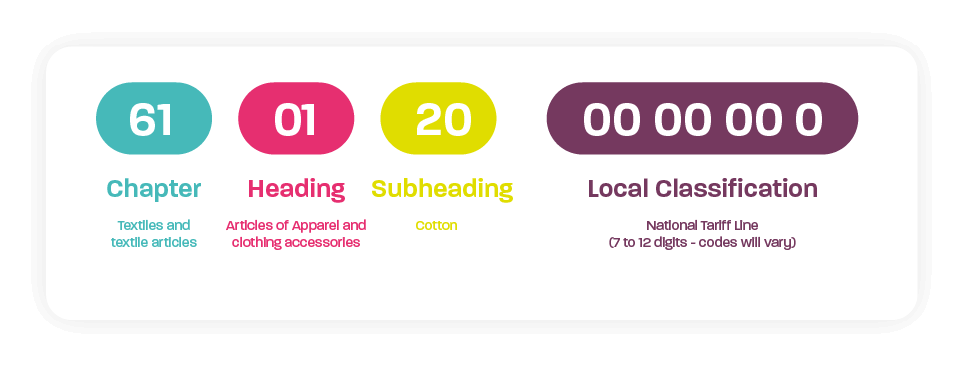

HS codes are divided into three sets of two-digit codes.

The first two-digits in the code are known as ‘chapter codes’. These digits are used to categorise the item in question so it can be identified in one of the 99-chapters.

Heading numbers are the second two-digits in the HS code structure. These digits represent the specific heading (or categories) within the ‘chapter codes’ the item in question is listed under.

Sub-heading numbers are the final two digits in the six-digit structure which are used to narrow the search further.

Chapter code: Textiles and textile articles (61)

Heading numbers: Articles of Apparel and clothing accessories (01)

Sub-heading: Cotton (20)

HS Code: 610120

This unique six-digit code will allow customs authorities in virtually any country to be able to identify and classify the contents of the container or item.

The Importance of HS Codes for Shippers

Seasoned shippers will know the correct classification of goods is a legal responsibility whether you are the importer or exporter. If the goods are to arrive uninterrupted as intended, having been correctly identified and classified by customs, at the final destination, HS codes are integral to the process.

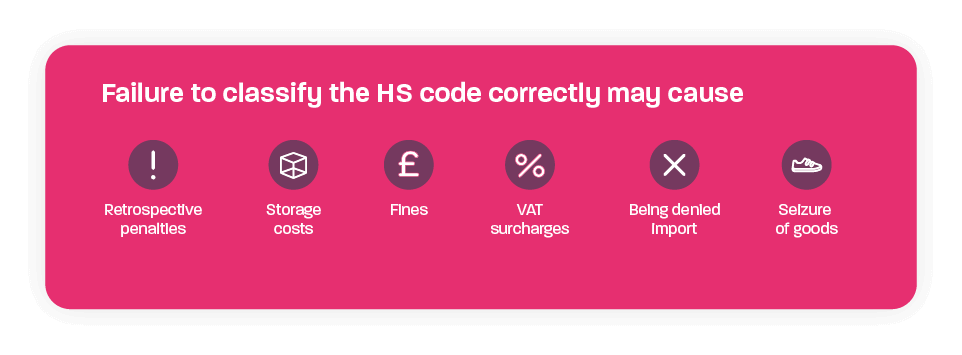

Failure to classify the HS code correctly may cause any shipment to be delayed while inspections are carried out, reducing your ‘free terminal time.’

Retrospective penalties, storage costs, fines, VAT surcharges, being denied import, seizure of goods are all common practice by customs for incorrect classification.

Experienced shippers who regularly import or export goods understand the close relationship between Duty Rates and HS codes and how they influence profitability.

When applied correctly, HS codes save shippers time, money, and labour. Imagine you regularly ship FCL or LCL ocean freight from Far East to UK for a variety of consumer goods, understanding duty tariffs is crucial in the shipping process.

Avoiding unnecessary delays smooths your relationship with customs while HS codes allow you to better identify whether your goods are subject to any additional tariffs upon arrival.

There is no way to predict unexpected costs, but should they arise this is an opportunity to settle any financial obligations in advance or at least flag the possibility of additional tariff costs to your customer.

Accurate Classification is Essential

Your products may be the best in the industry, but the accurate classification of HS codes is critical to the success of your cross-border shopping operation.

Put simply, the correct classification of HS codes keeps your customers satisfied, avoids friction with customs and ensures the safe and timely arrival of goods at the agreed cost.

Finally, preparation may seem dull and time-consuming when all you want to do is ship your goods, especially when the deadlines are tight.

However, if you’re new to the Harmonised System we recommended you seek advice from your local customs authority or an expert freight forwarder.

Research upfront and preparation will only benefit you in the long-term and help you grow your international retailing business whether you need to use ocean freight, air freight or rail freight.

Recent changes to commodity codes [2022]

After governmental review, the policies regarding UK commodity codes have changed. Eight new Tariff Headings have been added, with many codes being deleted, replaced, or completely new codes being added.

You can find the full details of the most recent changes on the Government site.

It must be remembered that it is the responsibility of the shipper to ensure they use the correct commodity code, so it is recommended that you can familiarize yourself with any changes that may effect you and your shipping needs.

Research upfront and preparation will only benefit you in the long-term and help you grow your international retailing business whether you need to use ocean freight, air freight or rail freight.

If you have any questions regarding commodity codes or the most recent updates, feel free to contact us.