The recent glow-up of the cosmetics market has been hard to avoid. An industry that was once dominated by pharmacies and supermarkets is now home to multi-million dollar DTC brands and innovative startups.

If you want to better understand the fast-growing cosmetics market and learn how your eCommerce store can make the most of these opportunities, we’re here to help.

Read this in-depth guide to cosmetics eCommerce to learn key stats, strategies and trends shaping the industry in 2024.

The growth of cosmetics in the UK

The UK cosmetics, beauty and health industry is growing rapidly, outpacing many other sectors and on path to reaching $5.71 billion in 2024 and exceeding $7 billion by 2027.

Growth isn’t limited to a single subsection of the market or product type, either. Fragrances have grown 9.4% since 2022, colour cosmetics have grown 8.9% and skincare has grown 11.8%.

Company names are a great example of the extent of the cosmetics sector’s growth. In the 2000s, just 32 live companies had “skincare” in their name. Since 2010, 367 company names have incorporated the term.

Worldwide growth of cosmetics

It’s not just in the UK where the cosmetics market is surging. The global market is huge. In 2023 alone, U.S. online beauty revenue exceeded $86 billion, with personal care sales totalling $54 billion.

China, the second largest global market, was predicted to reach $60.7 billion by the end of 2023, with cosmetics contributing $15 billion in revenue.

Growth is happening across the rest of the world, too. Sales in India are expected to hit $21 billion in 2027, and sales in the Middle East and Africa will reach $47 billion in the same year.

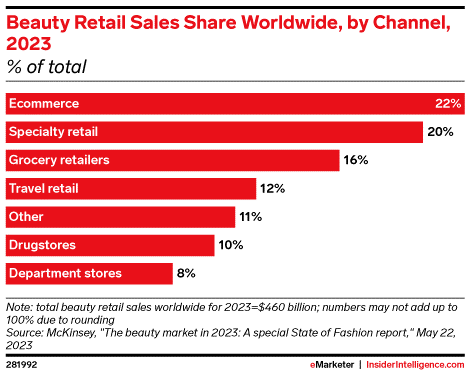

Online sales are key to the industry's success, and eCommerce is the sector’s biggest single sales channel. McKinsey estimates over 20% of all beauty retail sales occurred online in 2023.

The European market is equally strong. Revenue is expected to total almost $33 billion in 2024 and increase by one-third to over $40 billion by 2028.

What’s behind the growth in cosmetics?

There are several factors that explain the growth of the beauty and cosmetics market in the UK and beyond.

A great range of brands

The range of brands goes a long way to explaining the success of the cosmetics and beauty industry. Few other sectors boast such a wide range of brands at every price point, from well-known favourites like Boots and Superdrug to DTC brands like Glossier and high-end retailers like Fenty Beauty.

Adoption of the latest technology

Cosmetics brands are some of the most innovative and forward-thinking in all of online retail. In a sector where consumers have been testing products in-store for decades, online cosmetic brands have done an incredible job of replicating the in-store experience.

While online brands will never be able to completely replicate the experience of trying products in-store—one of the reasons D2C brands like Sephora have opened retail outlets—AR and VR tools go some way to recreating the experience.

Take Sephora’s Virtual Artist app, for example, which uses filters to mimic the effect of different products.

Don’t think these solutions are gimmicks, though — they’re incredibly effective at encouraging purchases.

A study by YouCam Makeup, a makeup try-on app, found users were 1.6 times more likely to buy items and spend 2.7 times more than non-app users.

Blurring lines between cosmetics, beauty and healthcare

Part of the reason for the surge in cosmetics is the blurring of lines between cosmetics, beauty, and healthcare. Looking good is only half the battle now. Consumers want to feel good, too.

As a result, supplements and vitamins are becoming more popular, whether that’s collagen, probiotics or Ayurvedic ingredients. These are seen as a convenient and non-invasive addition to healthcare routines that can solve a range of problems.

In fact, the personal care supplement market is forecast to increase by 13.6% compounding annually and hit $4.45 billion by 2033.

Exceptional consumer personalisation efforts

Personalisation should be a priority for any eCommerce brand. Research by McKinsey & Company finds that 71% of consumers expect companies to deliver personalised experiences and 76% are frustrated when this doesn’t happen.

But personalisation is even more important in the cosmetics and beauty space, where personalised recommendations make consumers 75% more likely to buy.

Beauty brands are particularly good at creating these experiences. Sephora’s mobile app is a great example, which features in-app messaging and recommendations based on the consumer’s hair and skin type.

Loyalty programs are also highly personalised, with offers and rewards based almost entirely on a consumer’s previous experiences.

How to reach cosmetics consumers in 2024

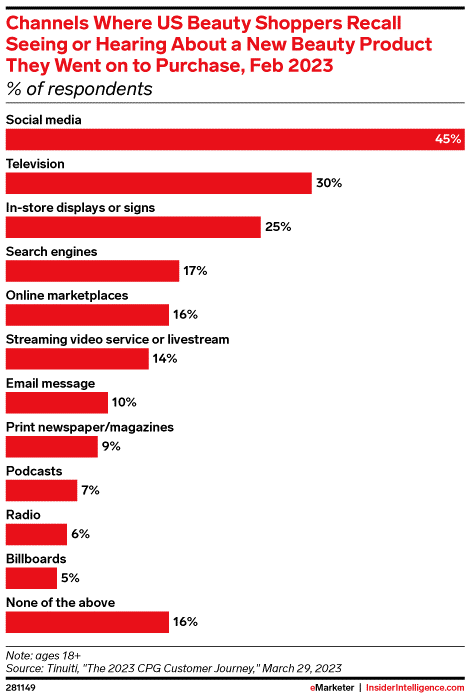

If you want to take advantage of the burgeoning cosmetics market, there are several excellent strategies you can use to reach consumers in 2024. In particular, brands looking to attract cosmetics consumers of almost any age should focus on social media above any other channel.

In fact, one of the reasons the industry is thriving is arguably a result of celebrities and online content creators promoting brands and creating tutorials. Social media is the most popular product discovery tool for U.S. consumers, with 45% saying they first hear about a product on social.

With that in mind, here are four social media-focused tactics to leverage.

Expand your reach with micro-influencers

Influencer marketing can be expensive. Those with 500,000+ followers can charge more than $10,000 per post.

But don’t worry if your brand can afford the giddy fees charged by the biggest influencers, use micro-influencers instead. Those with less than 50,000 followers may only charge a couple of hundred dollars for a post — offering exceptional value for money.

These influencers might not have the reach of Kylie Jenner, but they tend to have highly engaged audiences who act on their product recommendations.

It’s also worth noting that when working with influencers, brand sponsorships on social media platforms such as Instagram, TikTok and even on YouTube are great ways to improve your brand’s presence and reach to wider audiences.

Lean on user-generated content

User-generated content can be more powerful as influencer marketing campaigns in the cosmetics space. Research by Stackla finds that 42% of consumers say user-generated content is most influential when making beauty and health-related purchasing decisions. In comparison, just 10% said influencers were most influential.

Take advantage of this fact by encouraging customers to post product reviews on social media in return for discounts or offers like free delivery.

Turn social into a sales machine

Are you using social media to market your products or to sell them? A Statista report finds that revenue from social commerce will reach almost $80 billion by 2025 and account for 5.2% of all U.S. eCommerce sales.

Better still, almost two-thirds of consumers say they’re more likely to buy from brands if they can shop directly from a social media platform.

The result? Make sure you are taking advantage of in-app shopping features on platforms like Instagram and TikTok.

Shipping cosmetics with Pro Carrier

Whether you are already riding the wave of the online cosmetics market or are looking to enter it, trust Pro Carrier to deliver.

Our service offering was built by eCommerce experts specifically for eCommerce brands. As such, every part of our process is designed to maximise the customer experience, deliver the promises you make, and ensure local and international delivery is as stress-free as possible.

Our dedicated service reduces undeliverables, decreases WISMO calls, and lets you partner with best-in-class delivery partners. So whether you need to ship to the UK, Europe or Asia, we can deliver your cosmetics products anywhere you sell to.

Find out more about shipping across borders with Pro Carrier by speaking to our experts today.