Knowing your HS Codes from Commodity Codes

Whether you import products to the UK or serve customers in the EU, understanding HS codes and commodity codes is vital. Apply them correctly, and you’ll save time and money. Use the wrong codes, and you could face delays, fines and even have your goods withheld.

Luckily, this guide will tell you all you need to know. It will clear up the confusion about HS codes and commodity codes, explain when you need to use them and show you what can go wrong.

What is an HS Code?

HS Codes are part of the Harmonised System — a universal six-digit classification of trade products. These codes are used by customs authorities across the globe to identify and tax products and are included on every export document and commercial invoice.

When we say universal, we mean it. Over 200 countries and economies use these codes for custom tariffs, and they cover more than 98% of international trade. There are a staggering 5000+ commodity groups in total.

The Harmonized System is laid out in The International Convention on the Harmonized Commodity Description and Coding System and governed by the World Customs Organization.

The WCO manages matters relating to the HS through the Harmonized System Committee. The committee makes policy decisions, clarifies questions, prepares amendments and settles disputes.

How Are HS Codes Structured?

HS codes are split into three sets of two digits.

The first two digits are called chapter codes. These are used to categorise the item into one of 99 chapters. Chapter 1, for instance, is live animals. Chapter 10 is cereals.

The middle two digits are called heading numbers. They represent the specific heading (think category) within each chapter code.

The final two digits are called sub-heading numbers.

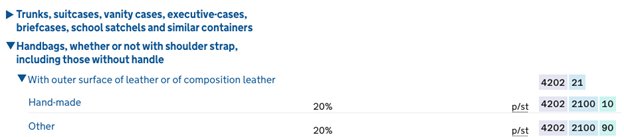

For example, leather handbags have the HS code: 420211

The chapter code is 42, which covers “articles of leather; saddlery and harness; travel goods, handbags and similar containers; articles of animal gut (other than silkworm gut).”

The heading number is 02, which covers “trunks, suitcases, vanity cases, executive-cases, briefcases, school satchels and similar containers.”

The sub-heading number is 21, which covers goods “with outer surface of leather or of composition leather.”

What is a Commodity Code

A commodity code (also called a tariff code) is a similar system used by EU and UK customs to describe goods being imported.

Unlike HS codes, commodity codes contain 10 or more digits. Luckily, the first six digits are the item’s HS code. Only the final four digits are different.

Let’s continue to use handbags as an example.

There are two UK commodity codes that cover leather handbags, depending on how they are made. Handmade leather handbags have the commodity code 4202210010. All other leather handbags have the commodity code 4202210090.

The Importance of HS and Commodity Codes for Retailers

Using the correct HS and commodity codes is essential if you want your goods to move smoothly through customs.

First of all, it is your legal responsibility to use the correct code. Apply them correctly, and you’ll pay the correct amount of tax while seeing your goods sail through customs.

Failing to correctly classify your goods, however, can mean delays to shipments while inspections are carried out. You may also face penalties, storage costs, fines, surcharges and even have your goods seized.

Incorrect classifications can also mean you’re overpaying duties and taxes. While it’s possible to make a retrospective claim for overpaid duties, the outcome is not always guaranteed.

How to find an HS Code or Commodity Code

The easiest way to find an HS code is to use the Government’s Online Tariff website.

For instance, a search for “tea” reveals four HS codes. One for green tea weighing up to 3kg, one for other green tea, one for black tea up to 3kg and a fourth for other black tea.

As you can see, each has the same Chapter code (09) and the same heading code (02) but different sub-heading codes.

This is also a good example of why choosing the correct HS code is so important. Green tea not exceeding 3kg is the only of these products that come with an additional 2% duty.

If your codes are wrong, you could be paying duties you don’t need to.

It’s also important to note that not every country will classify goods the same way. The commodity code you use to import goods into the UK may not be the right (or best) one to use when sending goods to customers in Europe.

Never Make a Mistake With Pro Carrier

Send goods with Pro Carrier and never worry about HS codes again. In our role as a third-party logistics provider, we’re responsible for correctly classifying your goods and ensuring they pass customs without a hitch.

Unlike other 3PL’s we have experience as an international freight forwarder and have been shipping goods across the globe for years. We know the importance of correctly classifying goods using HS and commodity codes and work diligently to ensure you always use the correct code.

Find out more about our services or speak to an expert today.